Philippine Competition Commission

Manila, Luzon Island, the Philippines, Aerial View of Port of Manila and Manila Bay

Situated in the Western Pacific Ocean, the Philippines is formed by over 7,600 islands, making it the world’s fifth largest island country. It is also one of the most populated countries, with its some 10 million nationals living overseas making up one of the world’s largest diasporas. As an active participant in global affairs, the archipelagic country is a founding member of the United Nations, World Trade Organization and Asia-Pacific Economic Cooperation (APEC), among other international organisations.

As an emerging market, the Philippines needs an effective competition law to promote economic growth and protect consumer welfare. In fact, back in 1987, a provision in the Philippine Constitution asserted that the “State shall regulate or prohibit monopolies when the public interest so requires”. To ensure efficient, consistent enforcement, a unified competition law, the Philippine Competition Act (PCA), was enacted in July 2015, and the Philippine Competition Commission (PCC) was established in February 2016 as the dedicated agency enforcing the PCA.

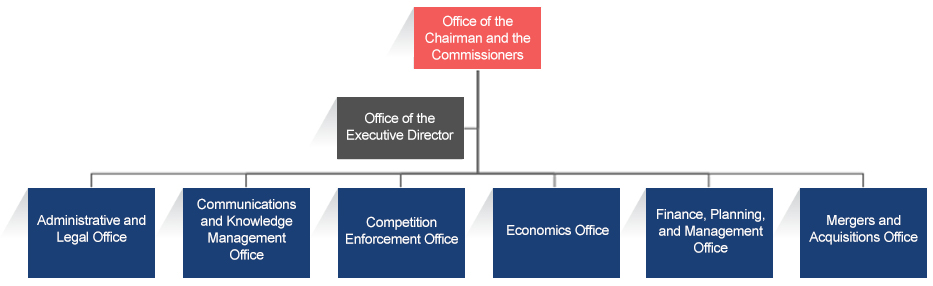

PCC's Organisation Structure and Mandate

The PCC is an independent, quasi-judicial body attached to the Office of the President. The Chairperson and four Commissioners, who are of equal ranks to a cabinet secretary and undersecretary respectively, are appointed directly by the President.

Though only slightly more than three years old, the PCC has quickly assembled its team, which at present comprises 161 members of staff. Currently at the helm is Chairperson Arsenio M. Balisacan, an economist with extensive experience in the government, the academia and international organisations including the World Bank.

Fig 1 Organisation structure of the PCC:

The PCC enjoys original and primary jurisdiction over the enforcement and implementation of the provisions of the PCA and the Implementing Rules and Regulations (IRR), which prohibits anti-competitive agreements, abuse of dominant position and anti-competitive mergers and acquisitions (M&A). The mandate of the PCC, as laid down in the PCA and IRR, includes:

• Review of M&A

• Investigation and adjudication of antitrust cases

• Imposition of sanctions and penalties

• Issuance of advisory opinions

• Conduct of economic and legal research on competition-related matters

• Advocating a pro-competition culture in the government and business sector

• Monitoring the environment for competition-relevant interventions

• Monitoring and analysis of the practice of competition in markets

Enforcement Work

Until June 2019, the PCC had processed 32 major stakeholder complaints. Subsequently, 12 preliminary inquiries had been completed, of which 11 had advanced into full administrative investigations. On 27 March 2019, the Enforcement Office filed one Statement of Objections before the Commission.

Key figures on enforcement work (1 July 2016 to June 2019):

| Enforcement of Rules & Regulations |

1 Jul-

31 Dec 2016 |

2017 | 2018 | Jan-Jun 2019 | Total |

| No. of major stakeholder complaints investigated | 3 | 11 | 6 | 12 | 32 |

| No. of preliminary inquiries completed | 1 | 4 | 6 | 1 | 12 |

| No. of full administrative investigations completed | - | 1 | 1 | 1 | 3 |

| No. of statements of objections filed | - | - | - | 1 | 1 |

On 19 January 2019, the PCC introduced a Leniency Programme, under which a current or former participant in a hard-core cartel may avail leniency, in the form of either immunity from suit, or exemption, waiver, or gradation/reduction of fines in exchange for the voluntary disclosure of information regarding such violations, subject to certain requirements.

Review of Merger and Acquisition

Between 1 July 2016 and 30 June 2019, the PCC had reviewed and decided on 113 M&A notifications which were worth a total of PhP 1.877 trillion (USD 36.65 million) in transaction value.

| Review of M&A | 2016 | 2017 | 2018 | 2019 | Subtotal 2 | Grand total 3 | |

| Feb-Jun 1 | Jul-Dec | Jan-Dec | Jan-Dec | Jan-Jun | |||

| No. of M&A notifications reviewed | 55 | 12 | 46 | 40 | 15 | 113 | 168 |

| Total transaction value (in PhP billion) | 745.95 | 786.19 | 372.63 | 493.87 | 223.88 | 1,876.57 | 2,622.52 |

Notes:

1. Pre-IRR period: Pursuant to PCC Memorandum Circular No. 16-001, M&A covered by its transitory rules are deemed to be approved.

2. The subtotal is for the period 1 July 2016 to 30 June 2019.

3. The Grand total is for the period from the inception of the PCC in Feb 2016 to 30 June 2019.

- Grab's acquisition of Uber: To address the competition concerns raised in view of the merger of the country’s two biggest ride-hailing apps, PCC subjected the transaction to pricing and quality standards after opening a motu proprio (on its own initiative) merger review. These conditions were part of Grab’s voluntary commitments and meant to ensure that its quality of service and pricing were not unreasonably different before and after it acquired Uber. A third-party trustee was appointed to independently monitor Grab’s compliance with its commitments.

- Udenna-KGLI-NM (2Go): PCC found a substantial lessening of competition in the market for passenger and cargo shipping services resulting from the transaction. This led to a review of the voluntary commitments proposed by the parties to address potential harm to the market. In January 2019, the PCC conditionally approved the transaction subject to certain conditions such as price monitoring measures, periodic operation reports, service quality requirements, etc.

In the past two years, a total of PhP 120.1 million (USD 2.3 million) in fines had been imposed on entities found to have violated the PCC’s rules on merger procedure. To date, the total fines collected amounted to PhP 41.2 million (about USD 0.8 million).

To improve the ease of doing business for merging parties, the PCC has modified its merger control regime so that the merger notification thresholds are adjusted annually based on the nominal GDP growth of the previous year. As of March 2019, the thresholds have been adjusted from PhP 5 billion to PhP 5.6 billion (USD 109.3 million) for the size of party, and from PhP 2 billion to PhP 2.2 billion (USD 42.96 million) for the size of transaction. Meanwhile, in a Commission Resolution issued in May 2019, the PCC set down the rules for an expedited review process – taking 15 working days instead of 30 calendar days for the regular phase 1 merger assessment – for transactions that are less likely to pose competition concerns. These include M&A involving parties with no actual or potential vertical or horizontal overlaps in the market; export-oriented Philippine operations with a global relevant geographic market; parties with a negligible Philippine presence, and real estate joint ventures. The new rules took effect on 2 July 2019.

Policy Advocacy

The PCC has been actively promoting the mainstreaming of competition principles within the government through policy advocacy and providing inputs to various executive and legislative branches. In 2018, it provided technical inputs to the Department of Information and Communications Technology and the National Telecommunications Commission during the selection process of a third player in the telecommunications market. It also provided policy recommendations to the Mobile Number Portability Act which aims to spur competition in the mobile network market.

In the belief that participation of foreign business players will intensify competition and help invigorate the domestic markets, the PCC has been a vocal supporter of policy reforms aimed at liberalising foreign access to investment opportunities in the Philippines. To this end, the PCC welcomed the filing of a Senate resolution to conduct an omnibus study for updating the Foreign Investment Acts, supported the amendment of the 80-year-old Public Services Act and the Retail Trade Liberalisation Act to encourage foreign companies to enter the Philippine markets.

Stakeholder Engagement

Since its inception, the PCC has conducted 83 advocacy and communication activities to inform the public about the PCA and to obtain stakeholders’ views on competition-related issues in various industries.

Targeting the public, the PCC organised regional roadshows to introduce the PCA, and promoted competition law through multi-media campaigns and advertising. In particular, it published the “Handbook for the General Public”, which, together with its “Guide for Businesses”, received the Awards of Excellence in the Philippine Quill Awards, an esteemed awards programme in the field of business communication.

|

And to engage specific stakeholders, the PCC organised year-round seminar series for law enforcement agencies, sector regulators and government-owned and controlled corporations; fostered dialogues with the business sector encompassing business chambers, trade associations, multi-national companies, micro, small and medium enterprises (MSMEs) and cooperatives; engaged the education sector, particularly students of economics, business, accountancy and marketing in senior high schools, colleges and universities; and liaised with the judiciary and law schools, which resulted in the integration of competition law in the corporation law subject for all law schools and its inclusion as a stand-alone elective in the curricula. |

In February 2018, the PCC also hosted the inaugural Manila Forum on Competition in Developing Countries for new and young competition authorities in Asia-Pacific to enter the global discourse on competition and learn from the cross-cutting experiences of developed and developing jurisdictions.

Sector Study

To date, the PCC has completed 39 policy research/sector studies which address market competition issues. 4 These include studies on the National Competition Policy, policy advisory on the Maritime Industry Development Plan, review of the 1987 Constitution, and economic analysis of Retail Competition and Open Access.

| Policy Research |

1 Jul-

31 Dec 2016 |

2017 | 2018 | Jan-Jun 2019 | Total |

| No. of policy research and/or sector studies conducted | - | 7 | 26 | 6 | 39 |

Notes:

4.The findings can be issued as policy note, issues paper, policy paper, position paper or market study.

These studies provide the PCC with the essential knowledge to put industries, sector regulators and consumers on notice, and offer guidance for future enforcement and advocacy actions.

Inter-government Co-operation

The PCC strives to build partnerships with key government agencies to achieve better synergy and co-ordinate efforts in the implementation of competition-related policies and measures. To date, the PCC has signed Memoranda of Agreement with the following agencies:

- Insurance Commission – to promulgate specific rules on the review of M&A of insurance companies, pre-need companies (authorized/ licensed corporations which provide future services or payment of money at the time of actual need) and health maintenance organisations that are under financial distress;

- Department of Justice – to pave the way for a harmonised referral system of complaints and preliminary investigation of competition law offences, and to coordinate the implementation of leniency programmes and witness protection;

- Office of the Ombudsman – to facilitate mutual notification on complaints involving the violation of competition and anti-graft laws;

- Public-Private Partnership Center – to formulate guidelines for the facilitation and review of public-private partnership projects;

- Integrated Bar of the Philippines – to undertake cooperative activities in fostering legal education and research on competition law and policies;

- Others: Energy Regulatory Commission, Department of Energy, Department of Trade and Industry, University of the Philippines College of Law, Bangko Sentral ng Pilipinas (Central Bank of the Philippines), Philippine Statistics Authority, Commission on Audit, Securities and Exchange Commission, and Office of the Secretary General.

Looking Ahead

The PCC’s efforts to foster competition in the country have been recognised by international observers. According to the Policy and Regulatory Report’s 2019 Global Trends Monitor, the Philippines was the fifth most active competition jurisdiction in Asia-Pacific in 2018.

The PCC has set clear plans to strengthen its work in various areas. For the review of M&A, the PCC will continue to proactively monitor non-notified transactions and evaluate the merging parties’ compliance with their voluntary commitments. In terms of enforcement, to use its enforcement resources more efficiently, PCC will issue the Rules on Forbearance to exempt an entity or group of entities from certain provisions of the PCA under very specific circumstances and stringent conditions. It has also submitted proposed Rules on Search and Inspection or dawn raids to the Supreme Court for approval. Together with the now running leniency programme, these will greatly enhance the PCC’s enforcement efficiency and effectiveness. In addition, together with the Office of the Ombudsman and the Commission on Audit, the PCC will adopt a tripartite action plan and form a joint task force to investigate bid-rigging in public procurement.

On the sector study front, the PCC will include new priority sectors such as logistics supply chain, corn milling and trading, refined petroleum manufacturing and trading, sugar and pesticides. The sectors identified remain consistent with the priorities laid down in the 2017-2022 Philippine Development Plan.

Tackling the challenge of low public awareness of the competition law and PCC, as well as the limited understanding of the principles of healthy market competition among business, consumers, and even government agencies, the PCC is committed to mainstream the culture of competition, not just among consumers and the business, but among members of Congress, sector regulators and the judiciary as well. The PCC also intends to implement a multi-year work plan to reviewing laws, bills and regulations that hamper competition, as well as establishing a quick-response mechanism to provide targeted, timely and informed comments on legislative proposals and executive issuances.

Furthermore, the PCC is mandated to assist the National Economic and Development Authority in preparing and formulating the National Competition Policy, which is envisioned to direct all government agencies to mainstream competition, strengthen the enforcement of competition law and ensure competitive neutrality. The Policy is expected to be issued within 2019 through an Executive Order. The PCC will also develop pilot-testing tools that will allow government agencies to self-assess their existing and proposed procedures from a competition policy perspective.

(Published in November 2019)