Competition and Consumer Commission of Singapore

Singapore may be barely a dot on the world map, but its importance to the global economy is far from tiny. Not only is it one of the biggest import and export countries in the world, but it is also one of the top five financial hubs, according to the latest Global Financial Centres Index. Both the IMD World Competitiveness Rankings and the World Economic Forum’s Global Competitiveness Report considered it to be the most competitive economy in the world in 2019.

The island city-state had vigorously reinvented itself since it became an independent republic in 1965. Through industrialisation and the development of the finance sector, it transformed from a low-income economy to a prosperous cosmopolitan where the GPD per capita based on purchasing power parity is one of the highest across the world today.

A robust regulatory and legal framework is key to keeping the Singaporean economy competitive and attractive to business and investment. In fact, the World Bank’s “Doing Business 2020 Indicators” rated Singapore as the second most business-friendly regulatory environment among 190 economies. In this regard, the Competition and Consumer Commission of Singapore (CCCS) has a crucial role to play.

Mandate and organisation

The CCCS is a statutory board under the Ministry of Trade and Industry. It was formerly known as the Competition Commission of Singapore, which was established on 1 January 2005 to administer and enforce the Competition Act (Chapter 50B). In April 2018, it was renamed the CCCS after taking on the additional function of administering the Consumer Protection (Fair Trading) Act (Chapter 52A), which protects consumers against unfair trade practices in Singapore.

Functions

As circumscribed by the Competition Act, the functions and duties of the CCCS are to:

- maintain and enhance efficient market conduct and promote overall productivity, innovation, and competitiveness of markets in Singapore;

- eliminate or control practices having adverse effect on competition in Singapore;

- promote and sustain competition in markets in Singapore;

- promote a strong competitive culture and environment throughout the economy in Singapore;

- act internationally as the national body representative of Singapore in respect of competition matters and consumer protection matters;

- promote fair trading practices among suppliers and consumers and enable consumers to make informed purchasing decisions in Singapore;

- prevent suppliers in Singapore from engaging in unfair practices;

- administer and enforce the Consumer Protection (Fair Trading) Act; and

- advise the Government, other public authorities or consumer protection organisations on national needs and policies in respect of competition matters and consumer protection matters generally.

Organisation

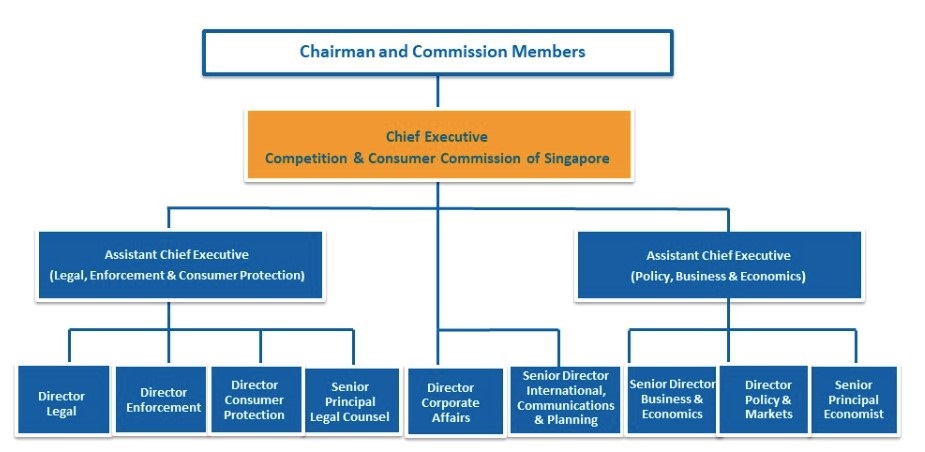

The Members of the Commission are directly appointed by the Minister of Trade and Industry. Currently, the agency has nine members, including the Chairman, Mr Aubeck Kam, who is Permanent Secretary for the Ministry of Manpower. Ms Sia Aik Kor, former deputy Chief Counsel at the civil division of the Attorney-General’s Chambers, took up the position of Chief Executive in October 2019.

The CCCS’s work is supported by seven divisions, namely (1) Business and Economics, (2) Consumer Protection, (3) Corporate Affairs, (4) Enforcement, (5) International, Communications and Planning, (6) Legal and (7) Policy and Markets.

As of January 2020, the agency had 71 members of staff.

Fig. 1 Organisational chart of the CCCS:

Enforcement work

The CCCS’s core duty in the competition aspect is to investigate practices – primarily mergers and acquisitions, cartels, and abuse of dominant position – that harm competition in Singapore, and enforce the Competition Act accordingly. To date, the CCCS has completed more than 500 cases and issued 16 infringement decisions across various sectors such as manufacturing, transport, hospitality and food, with fines amounting to over SGD80 million.

Fig. 2 Summary of CCCS’s enforcement work since its inception:

| Status as at 31 Dec 2019 | |

|---|---|

| Preliminary Enquiries | 134 |

| Investigations (excluding Leniency) | 48 |

| Leniency | 28 |

| Notifications for Guidance or Decision | 32 |

| Merger Notifications (Phase 1) | 76 |

| Merger Notifications (Phase 2) | 10 |

| Pre-Notification Discussion | 17 |

| Appeals | 10 |

| Competition Advisories | 209 |

| Market Studies | 26 |

| TOTAL (excluding complaints) | 590 |

Recent enforcement work

In 2019, the CCCS issued an infringement decision against the owners/operators of four hotels for exchanging commercially sensitive information on room rates offered to corporate customers. More recently, it has issued a proposed infringement decision against contractors for bid rigging in relation to the provision of building, construction and maintenance services.

Singapore adopts a voluntary merger regime based on self-assessment. The CCCS reviewed five notifications in 2019 which spanned various industries including food products, healthcare and building materials. Three acquisitions were cleared whereas conditional approval was given to a merger involving private clinical laboratories which entailed commitments pertaining to non-exclusivity and price. Another in-depth review of a merger between Korean shipbuilders is underway.

In 2019, the CCCS published findings of a study on the online bookings of flight tickets and hotel accommodation for Singapore consumers, with proposed recommendations to encourage online travel booking providers to adopt transparent pricing practices. It was the agency’s first market study that examined both competition and consumer protection issues.

Consumer protection activities

Prior to taking over the consumer protection responsibility in 2018, the CCCS had been cognizant of the complementary relationship between competition and consumer protection, and had been involved in work that encompassed both elements. For example, its market inquiry into the supply of formula milk facilitated the entry of new formula milk products resulting in more choices for consumers. The market inquiry also aimed to promote consumer awareness of health and nutritional claims or idealised images on formula milk cans which may mislead parents. Another market inquiry that the CCCS conducted was on the supply of car parts in Singapore which had resulted in major authorised car dealers in the country removing warranty restrictions to customers who service or repair their cars at independent workshops. This allows independent car workshops to compete fairly with authorised workshops and gives consumers more choices.

To date, the CCCS has completed 35 preliminary inquiries and 7 investigations pertaining to consumer protection enforcement. In a notable case, an undertaking from food and beverage outlet Charcoal Thai 1 was secured, putting an end to the display of misleading representations on discount period in its promotional materials. In another case, following an injunction application filed by the Commission, a Court Order was issued against SG Vehicle, a local car dealer, to cease its unfair trade practices relating to misrepresentation on terms and conditions of its sale agreement.

The CCCS also drafted a set of guidelines on price transparency to educate suppliers and reduce the occurrence of misleading pricing practices. The guidelines are expected to be finalised in 2020.

Competition advocacy

The CCCS has a statutory duty to advise the government or other public authorities on national needs and policies in respect of competition matters. Government agencies are encouraged to approach the CCCS if they require advice on the possible competition impact of their policies and initiatives, and the alternatives that can reduce such adverse impact. To date, the CCCS has completed more than 200 competition advisories to government agencies.

Assistant Chief Executive (Policy, Business & Economics) Ms Ng Ee Kia on Panel (COPCOMER Regulator Tea)

Meanwhile, the CCCS regularly reaches out to government agencies and officers to raise awareness of competition and consumer protection matters. In this regard, the CCCS facilitates the Community of Practice for Competition and Economic Regulations (COPCOMER), an interagency platform for the CCCS, sectoral competition regulators and a few other government agencies to share best practices and experiences on competition, consumer protection and other regulatory matters. In 2019, the CCCS organised the COPCOMER Regulators’ Tea on the topic “Digital Platforms – Interplay between Competition, Consumer Protection and Data Privacy”. The CCCS also works with the local Civil Service College to conduct courses for government officers on competition policy and regulations.

In addition, the CCCS partners with government agencies on projects that can bring about benefits or raise awareness of competition across various sectors. For instance, it collaborated with the Personal Data Protection Commission (PDPC) on a discussion paper on the impact of data portability on business innovation, market competition and consumers; organised a seminar on the interface between IP and Competition Law with the training arm of the Intellectual Property Office of Singapore (IPOS); worked with the Info-communications Media Development Authority on a federated locker system to improve the efficiency of last mile delivery and productivity in the domestic logistics sector; and engaged relevant agencies to understand the regulations governing the import and sales of formula milk, as part of the aforementioned market inquiry into the supply of formula milk for infant and young children in the country.

The CCCS believes that enforcement and advocacy must go hand-in-hand to be effective and efficient in administering the law. As investigations are resource intensive, advocacy can help minimise inadvertent transgressions and thereby the use of public resources. The CCCS therefore regularly conducts outreach sessions for businesses and trade associations on different topics, such as preventing bid rigging in procurement, dos and don’ts of competition law and how businesses can comply with the law. Where necessary, the CCCS will publish guidance notes for specific sectors, for example, an Airline Guidance Note was issued to provide airlines with more clarity on the competition assessment of airline alliance agreements.

Promoting competition in the digital age

The CCCS recognises that developments brought by the digital economy can lead to a more competitive landscape by reducing barriers to entry, while at the same time, reduce competition in the market when network effects act as a barrier to entry. To ensure its detection and enforcement remain robust, the CCCS conducts horizon scanning on a regular basis.

Market study is one of the tools applied by the CCCS to monitor key developments in the digital economy and to understand how digital e-commerce platforms potentially impact markets, businesses and consumers in Singapore. A recent example is the study on the online provision of bookings for flight tickets and hotel accommodation. The CCCS is currently conducting research to better understand digital platforms, as well as the geographic market definition for cross-border cases.

The CCCS also works with other government agencies to achieve synergy and share knowledge. Towards this end, the Commission partnered with PDPC and IPOS on a research project to understand the implications of the proliferation of data analytics and data sharing on competition policy and law, personal data protection regulation and intellectual property law in Singapore. The research culminated with the publication of a CCCS occasional paper titled “Data: Engine for Growth-Implications for Competition Law, Personal Data Protection, and Intellectual Property Rights”.

Separately, the CCCS participated in the Regulators Roundtable with government agencies that deal with legal, ethical, policy and governance issues arising from the commercial deployment of Artificial Intelligence (AI), and provided inputs to the Model AI Governance Framework and its accompanying guide published by the PDPC to state clearly that organisations should comply with existing laws and regulations in Singapore, including the Competition Act.

At the regional level, the CCCS collaborated with other ASEAN competition authorities to produce the Handbook on E-commerce and Competition in ASEAN in 2017. The handbook provides a reference for competition authorities when assessing anticompetitive conduct related to e-commerce. The CCCS also organised a roundtable discussion where senior officials from ASEAN competition authorities discussed the challenges faced and potential areas of future cooperation on e-commerce related cases.

International activities

The CCCS actively participates in regional and international competition and consumer platforms such as the ASEAN Experts Group on Competition, the Competition Policy and Law Group in APEC, the International Competition Network (ICN), the ASEAN Consumer Committee on Consumer Protection and the Organisation for Economic Cooperation and Development (OECD).

The CCCS has entered into cooperation agreements with a number of other competition agencies, including the Japan Fair Trade Commission, Indonesia’s Competition Commission and the Competition Bureau Canada. The MoU with Canada is the first MoU between the CCCS and an overseas enforcement agency that covers both competition and consumer protection laws. Furthermore, the CCCS signed up for the ICN Framework on Competition Agency Procedures (CAP) to ensure that competition procedures adopted by Singapore are in line with international best practices.

The CCCS leverages its international engagement efforts to strengthen the implementation of competition law in ASEAN. Together with other ASEAN competition agencies, it adopted the ASEAN Regional Cooperation Framework for Competition to enhance cooperation in the region. While chairing the ASEAN Experts Group on Competition, the CCCS established the ASEAN Competition Enforcers’ Network (ACEN) in 2018 to facilitate cooperation on competition enforcement in the region. The network also serves as a platform to handle cross-border cases, such as the Grab-Uber merger. The CCCS also initiated the development of the ASEAN Competition Compliance Toolkit as a guidance for ASEAN Member States to promote business compliance, and organised capacity building workshops on due process and compliance in partnership with the ICN for ASEAN, among others. Other forms of technical assistance include offering secondment opportunities for staff of other ASEAN competition agencies to work at the CCCS.

The CCCS also actively and candidly shares its experiences in relation to the implementation of competition and consumer laws and policies at various regional and international platforms. In November 2019, the CCCS was invited to share Singapore’s consumer protection policy framework and its role in advocacy and enforcement at a training session with the Ministry of Finance & Economy, Brunei Darussalam.

Virtual ASEAN Competition Research Centre

In its capacity as a member of the ICN Steering Group and a co-chair of the ICN Advocacy Working Group (AWG), the CCCS led projects to facilitate and encourage experience sharing among competition agencies, including organising teleseminars and sessions at an AWG workshop and the ICN Annual Conference, as well as compiling ICN Members’ experiences on conducting advocacy in digital markets.

The CCCS also believes that research can contribute to the development of competition and best practices. To this end, the CCCS led the establishment of the Virtual ASEAN Competition Research Centre to promote research collaboration in the region and host a repository of research articles and profiles of researchers and academics who are interested in the subject.

Moving forward

Going forward, the CCCS will continue to strengthen its oversight of competition and consumer protection in Singapore to grow a vibrant economy with competitive markets and innovative businesses. It will further its efforts in coordinating its competition and consumer protection functions with the aim of creating synergy for its work.

Its key initiatives for 2020 will focus on facilitating the country's digital economy, empowering and protecting consumers, and fostering a pro-enterprise and pro-innovation ecosystem. The key sectors of focus will include digital platforms, building, construction and maintenance services, and the beauty and wellness sectors.

On another front, the CCCS will be consulting relevant stakeholders on the review of its Block Exemption Order for liner shipping agreements, taking into consideration recent industry and regulatory developments. It is also drafting a guidance note on how businesses can collaborate in compliance with competition law.

(Published in April 2020)