Competition Authority of Kenya

Kenya is located in East Africa, bordering the Indian Ocean and five other countries. Its landscape – notably the vast savannas – not only attracts millions of tourists in a regular year, but also forms the backdrop of a dynamic economy that is among the largest and most developed on the continent. The World Bank’s data show that the country’s economic growth averaged 5.7% between 2015 and 2019, and its 2021 projected real GDP growth is 7.6% according to the International Monetary Fund.

A large pool of highly educated and skilled workers, as well as a high level of IT literacy and innovation contribute to the country’s steady economic growth. In recent years, robust development has been seen in various sectors, particularly telecommunications. This is confirmed by a headline in the Harvard Business Review in February 2021 that reads, “Kenya Is Becoming a Global Hub of FinTech Innovation”.

The World Bank suggests that Kenya has the potential to be one of Africa’s success stories. To overcome the major hurdles on the path including inequality, low investment and low firm productivity, fostering market competition will be key.

Mandate and organisation

Before and immediately after independence, which was declared in 1963, Kenya was largely a command economy, under which the Price Control Act of 1956 facilitated the fixing of commodity prices. As the country pivoted towards a free market economy in the 1980s, the government recognised the need for competition law, and the Restrictive Trade Practices, Monopolies and Price Control Act came into force in 1989.

The legislation, implemented by the Monopolies and Prices Commission under the Ministry of Finance, covered most competition policy issues such as restrictive trade practices and mergers. Nevertheless, some laws continued to grant immunity to businesses to legally engage in anti-competitive practices. To seal these regulatory loopholes, and to support an economy that was progressively being liberalised, it became necessary to enact an effective competition law, and to position consumer protection under an agency.

In 2010, the Competition Act No. 12 of 2010 (the Act) was enacted, and the Competition Authority of Kenya (the CAK or the Authority) was established to enforce the Act. The Act has been amended several times since then to address weaknesses limiting its scope of application and to facilitate the work of the CAK in addressing emerging issues in the economy.

Role and functions

It is the vision of the CAK to achieve “a Kenyan economy with globally efficient markets and enhanced consumer welfare for shared prosperity”. As circumscribed by the Act, the Authority has the following functions:

- Promote and enforce compliance with the Act

- Receive and investigate complaints from legal or natural persons and consumer bodies

- Promote public knowledge, awareness and understanding of the obligations, rights and remedies under the Act and the duties, functions and activities of the Authority

- Promote the creation of consumer bodies and the establishment of good and proper standards and rules to be followed by such bodies in protecting competition and consumer welfare

- Recognise consumer bodies duly registered under the appropriate national laws as the proper bodies in their areas of operation to represent consumers before the Authority

- Make available to consumers information and guidelines relating to the obligations of persons under the Act and the rights and remedies available to consumers under the Act

- Carry out inquiries, studies and research into matters relating to competition and the protection of the interest of consumers

- Study government policies, procedures and programmes, as well as legislation and proposals for legislation so as to assess their effects on competition and consumer welfare and publicise the results of such studies

- Investigate impediments to competition, including entry and exit from markets, in the economy as a whole or in particular sectors and publicise the results of such investigations

- Investigate policies, procedures and programmes of regulatory authorities so as to assess their effects on competition and consumer welfare and publicise the results of such studies

- Participate in deliberations and proceedings of government, government commissions, regulatory authorities and other bodies in relation to competition and consumer welfare

- Make representations to the government, government commissions, regulatory authorities and other bodies on matters relating to competition and consumer welfare

- Liaise with regulatory bodies and other public bodies in all matters relating to competition and consumer welfare

- Advise the government on matters relating to competition and consumer welfare.

Organisation

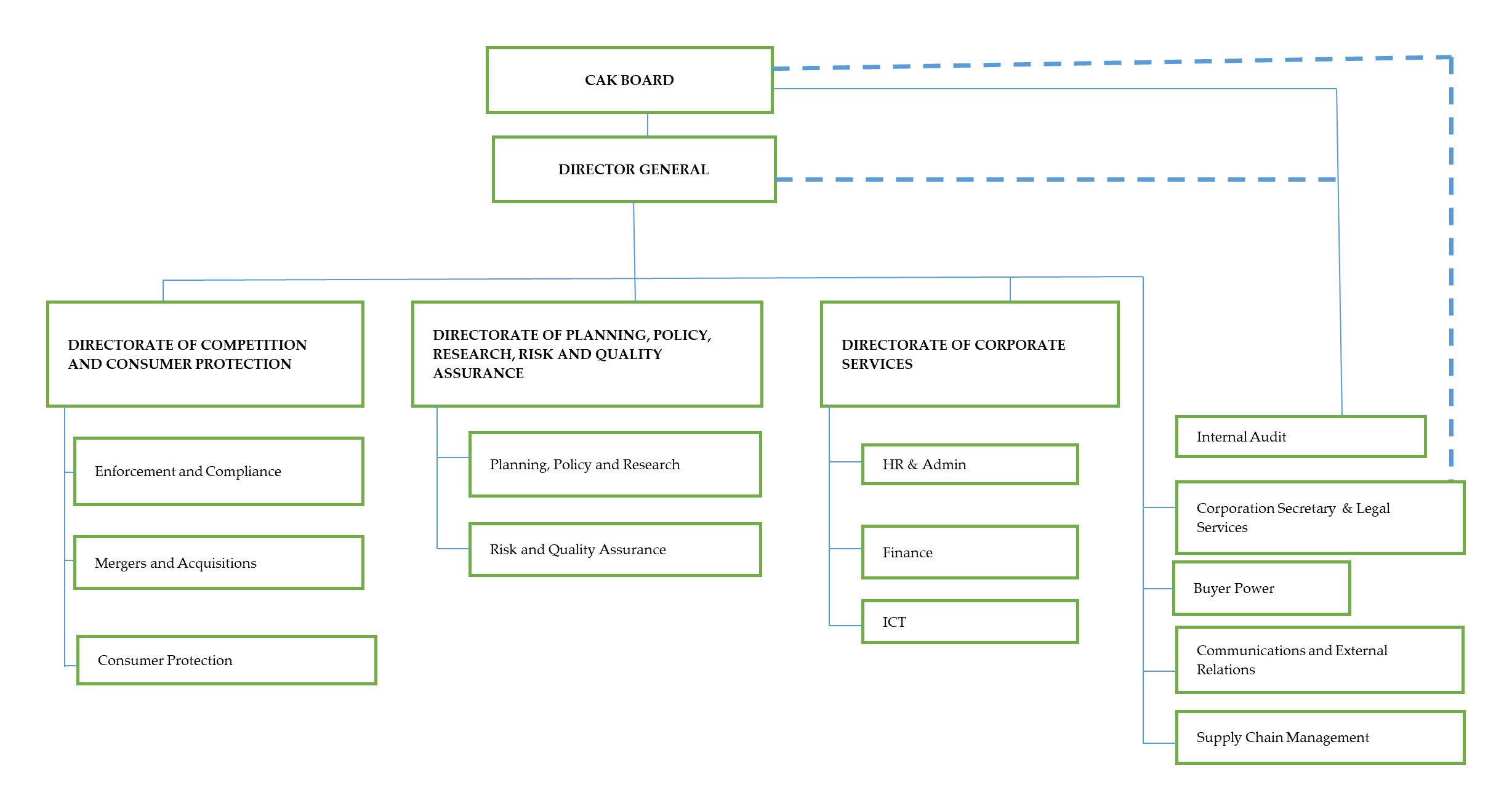

The CAK is governed by a Board comprising a Chairperson, five independent members and the Authority’s Director-General. Accountable to the Government of Kenya through the National Treasury and Planning, the Board is responsible for the overall strategic direction and operational guidance of the Authority, whereas the Director-General is responsible for the day-to-day management of the Authority and advising the Board.

Fig. 1 Organisational chart of the SIC:

Enforcement work

Investigation into restrictive trade practices

Restrictive trade practices, according to Part III of the Act, include restrictive agreements, practices and decisions, restrictive trade practices applicable to trade associations, and abuse of dominant position. The Enforcement and Compliance Department is responsible for investigating alleged contraventions.

In 2020, the CAK investigated 40 cases and imposed financial penalties and restraining orders on undertakings that had infringed provisions of the Act.

Merger review

According to the Act, all undertakings involved in a merger transaction are required to notify the CAK.

In 2020, the CAK received 121 merger notifications, the majority of which came from the manufacturing (17.4%), distribution (9.9%), information and communications technology (8.3%), energy (7.4%) and retail distribution (5.8%) sectors.

In December 2019, a single notification regime was introduced through the Competition (General) Rules 2019 to streamline the process of regional merger notification. Prior to its introduction, transactions with a regional dimension were notifiable to both the CAK and the COMESA (Common Market for Eastern and Southern Africa) Competition Commission (CCC). Under the new regime, mergers in which at least two-thirds of the merging parties’ combined turnover or assets (whichever is higher) in the common market is generated or located in Kenya will only need to be notified to the CAK, and the remaining only to the CCC.

Abuse of buyer power

The Act was amended in 2016 to introduce provisions on abuse of buyer power and again in 2019 to clarify the law and expand the CAK’s mandate in this regard.

Buyer power is defined as “the influence exerted by an undertaking or a group of undertakings in the position of purchaser of a product or service to [either] obtain from a supplier more favourable terms, or impose a long-term opportunity cost including harm or withheld benefit, which, if carried out, would be significantly disproportionate to any resulting long-term cost to the undertaking or group of undertakings”. Examples of abuse of buyer power include delays in payment of suppliers without justifiable reason in breach of agreed terms of payment, and demands for preferential terms unfavourable to the suppliers or demanding limitations on supplies to other buyers.

To counter such abuse, the Act makes it mandatory for contracts between buyers and suppliers to contain certain minimum requirements, including terms of payment, conditions for termination and variation of contracts, and mechanisms for dispute resolution.

The CAK is mandated to investigate sectors or specific market players that are experiencing or are likely to experience incidences of abuse of buyer power. It may monitor the activities of a sector or undertaking and impose reporting and prudential requirements to pre-empt or remedy the abuse of buyer power. It is also empowered to require associations and players in sectors where instances of abuse of buyer power are likely to occur to develop a binding code of practice, which is published by the Authority to give it legal enforceability.

In 2020, the Authority investigated 32 complaints of abuse of buyer power, the majority of which arose from the retail (28%) and insurance (38%) sectors and government procurements (14%). Delayed payment was found to be the most prevalent conduct of abuse of buyer power in the investigations.

In response to the investigation findings, the Authority had carried out surveillance of the retail sector to investigate widespread delaying of payments owed to mainly SME suppliers, and subsequently issued orders against one retailer. It is currently conducting another surveillance exercise to pre-empt recurrence of incidences of abuse of buyer power in the retail sector. It is also engaging stakeholders of the retail and insurance sectors to facilitate the development and implementation of binding codes of practice and template contracts for supply of goods and services.

Informant Reward Scheme

On 1 January 2021, the CAK launched the Informant Reward Scheme to encourage whistleblowing on anti-competitive conduct, particularly cartel-type activities like price fixing, controlling production levels, market allocation, and collusive tendering. The scope of the Scheme also extends to misrepresentation and safety of products, abuse of dominance, abuse of buyer power, mergers implemented without approval and unconscionable conduct.

An informant who is privy to insider information without being a party to the anti-competitive conduct under investigation and whose intelligence leads to the closure of the investigation through penalisation is entitled to up to 1% of the administrative penalty imposed by the CAK, capped at Ksh.1 million (about USD 9000).

The Authority has established a controlled mode of communication to ensure that the informant’s identity and intelligence are, from the first point of contact, restricted to a single focal point in the Authority. All employees of the Authority are prohibited by the Act from disclosing information that comes into their custody while undertaking their duties. Further, a secure email address, [email protected] , has been set aside. The Authority also collaborates with other government agencies to ensure that the confidentiality and safety of the informants are guaranteed.

Consumer protection activities

In 2020, the CAK handled 178 consumer complaints, an increase of 28% over the previous year. This is attributable to the Authority’s efforts to sensitise consumers about their rights, obligations and the complaints handling mechanism. Most of the complaints involved businesses in the manufacturing, financial services, insurance, transportation, storage, accommodation and food services sectors.

In addition, it finalised investigations targeting manufacturers of bread, edible oils and fats, fruit juices and maize flour and issued Orders against those found to have breached the Act such as by making false and misleading representations to consumers.

Advocacy & research

The CAK is mandated to advise the national and county governments on matters relating to competition, consumer welfare and abuse of buyer power through reviewing proposed legislation and issuing advisory opinions. In 2020, the Authority issued four advisory opinions on various policies and legislation regarding the leather, tea, sugar and aviation sectors.

Meanwhile, the CAK periodically conducts market inquiries to identify and address concerns in the economy under its mandate. A recent inquiry into the digital lending market, aimed at identifying and addressing consumer protection concerns in the regulated and unregulated digital credit markets, is due for finalisation in June 2021.

Additionally, the CAK strives to sensitise different stakeholders on competition-related issues. For instance, it engaged over 100 lawyers, trade associations, consumer bodies, sector regulators, government agencies and corporates in June 2020 to promote the Competition (General) Rules 2019. It also sensitised the officials of 16 county governments on the salient provisions of the Act and furnished them with a competition assessment tool for reviewing their proposed bills and flagging clauses that may reduce or impede competition. In September 2020, the Authority hosted its annual capacity-building programme to discuss emerging issues in competition, consumer welfare and abuse of buyer power. The virtual event attracted some 300 competition practitioners from across the world.

On the front of consumer protection, the CAK organised during the year several advocacy and sensitisation sessions with sector regulators with whom it has in place Memorandum of Understanding agreements, including a session conducted in collaboration with the Kenya Civil Aviation Authority to raise awareness among consumers of their rights and ways to report violations.

Mr. Gideon Mokaya, Manager Enforcement & Compliance, addressing delegates on a session to commemorate the World Competition Day 2019

Regional and international cooperation

Kenya is a member of various regional competition bodies, including the COMESA Competition Commission (CCC), the East African Community Competition Authority and the African Competition Forum (ACF). The CAK plays an active role in regional competition enforcement. It has entered into formal cooperation agreements with two competition regulators in Africa, namely the Competition Commission of South Africa and CCC.

The Authority also actively participates in international competition activities. Last year, it hosted the International Competition Network (ICN) Merger Working Group Webinar on Sound Decision Making, which aimed at promoting best practices in the design and operation of merger review. It also shared its views on spurring regional integration in Africa and the impact of the Covid-19 pandemic at the webinar titled “Key Competition and Consumer Protection Priorities for Regional Integration in Africa” organised by the United Nations Conference on Trade and Development.

Response to COVID-19

Following the confirmation of the first Covid-19 outbreak in Kenya in March 2020, the CAK initiated investigations into over 100 businesses across 15 counties, with the intention of detecting businesses that might be colluding to increase prices and hoard consumer goods, particularly pharmaceutical products and basic commodities. Retailers found to have contravened the Act were ordered to refund their customers, refrain from repeating the conduct and develop a competition compliance programme to sensitise their employees on restrictive trade practices and consumer welfare.

The CAK also issued an order to major manufacturers and distributors of essential foodstuffs and commodities, including maize flour, wheat flour, edible oils, rice, toilet papers, sanitizers and facemasks, to expunge those that had entered into exclusive agreements without the Authority’s approval. The manufacturers and distributors were ordered to cease and desist from entering into such exclusive agreements unless authorised by the Authority. Furthermore, distributors who operate their own retail outlets were ordered to avail the aforementioned essential commodities and other commodities they distribute to other retail outlets on non-discriminatory terms.

To address supply chain challenges which may be occasioned by the Covid-19 pandemic, the Authority has developed Draft Block Exemptions to exclude certain decisions, practices or agreements between manufacturers, distributors or retailers of essential commodities and foodstuffs from certain sections of the Act. By allowing certain business coordination between competitors in the supply chain during the pandemic, these exemptions help prevent a decline in the production, distribution and retail of essential commodities and foodstuffs in the market and serve to support the programmes designed to fight the spread of Covid-19.

Meanwhile, the CAK conducted a study into the airline industry in collaboration with the ACF seeking to identify competition and consumer welfare concerns and gauge the impact of the Covid-19 pandemic on the critical sector.

Future priorities

Looking ahead, the CAK will focus on building its investigation and enforcement capacities in the digital markets, and detecting bid rigging in public sectors, especially in relation to the construction and hospitality sectors.

In terms of merger reviews, its priorities include big data and digital markets with a focus on data-derived market power and dominance, killer mergers, and joint ventures occasioned by the Covid-19 pandemic, especially in the aviation industry.

In the area of consumer protection, it seeks to increase detection and deterrence of misleading and unfair practices that harm consumers with a focus on the utility sector, pharmaceuticals, big data, technological advancements, digital lenders, insurance, aviation and children’s products. It will also endeavour to raise awareness among consumers and businesses of their rights and obligations, the Authority’s mandate and the complaints handling system.

The CAK's advocacy effort will lean towards collaboration with institutions of higher learning with a special focus on research, capacity building of local and international stakeholders, and enhanced collaboration with sector regulators in areas of concurrent jurisdiction.

Regarding regional and international cooperation, it will strive for enhanced collaboration with the ACF, and continue to participate in ICN activities as speakers and workshop hosts.

(Published in June 2021)