Competition and Consumer Protection Commission

Dublin, Ireland

Ireland – the birthplace of four Nobel laureates in literature, U2 rock band and Guinness stout beer, among other things – is one of the wealthiest countries in the European Union (EU).

Though it has a small population of 5 million, Ireland is a key global player in financial services, high technology and life science. Thanks to a business-friendly environment and an attractive tax regime, many large multinational corporations have relocated their economic activities to the country. In fact, tech giants like Google, Apple and IBM, and world-leading pharmaceutical companies such as Pfizer and GSK, are basing their European operations in the island state.

Being a small open economy dependent on international trade, Ireland relies on sound competition regulations to thrive.

Mandate and organisation

Prior to the establishment of the Competition and Consumer Protection Commission (CCPC), competition law and consumer protection legislation were enforced in Ireland by the Competition Authority (established in 2002) and the National Consumer Agency (established in 2007) respectively. The two bodies were amalgamated in 2014 to form the CCPC, which has since been carrying out the functions previously exercised by its two predecessors, plus some additional responsibilities.

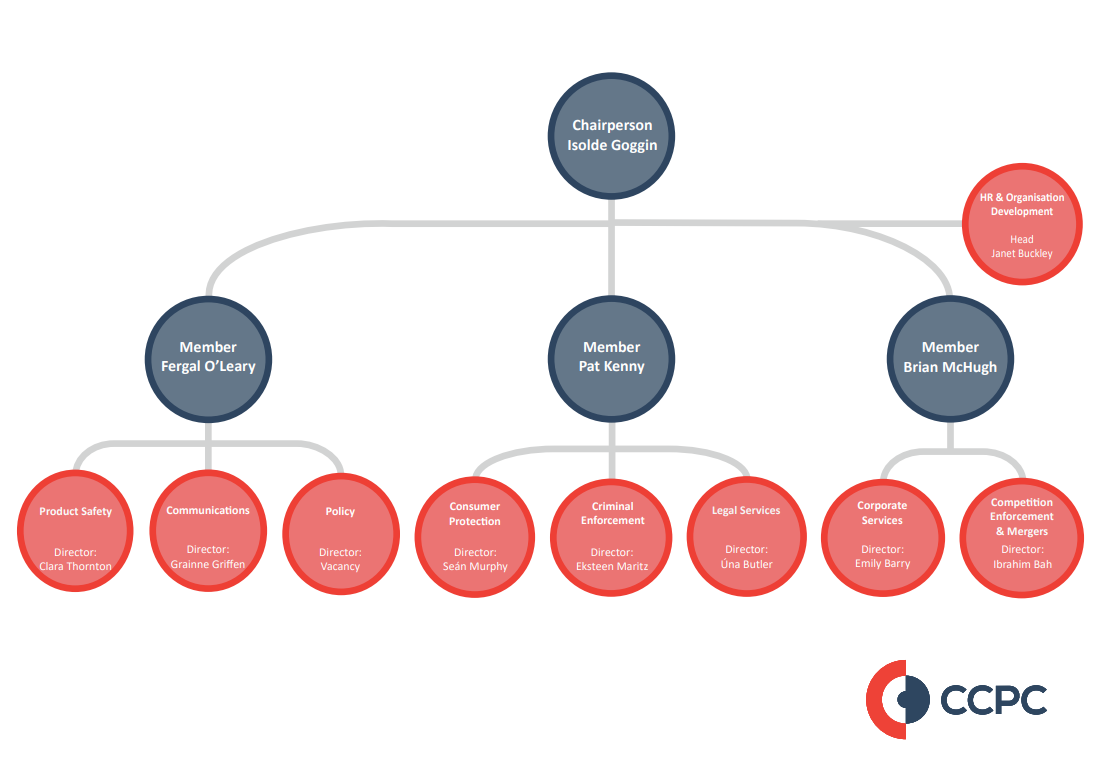

Organisation

The CCPC is an independent statutory body under the Department of Business, Enterprise and Innovation (DBEI). It is governed by a Commission consisting of a Chairperson and three full-time Members, who are responsible for making key statutory decisions on top of undertaking executive responsibilities.

Left to right: Member - Fergal O'Leary, Chairperson - Isolde Goggin, Members - Pat Kenny and Brian McHugh

The organisation’s work is split between nine divisions, namely Competition Enforcement and Mergers, Criminal Enforcement, Brexit and International, Consumer Protection, Product Safety, Legal Services, Communications and Policy, Organisational Development, and Corporate Services. As of July 2020, the CCPC has 111 staff members.

Fig. 1 Organisational chart of the CCPC:

Strategy Statement

The CCPC’s areas of focus are guided by its Strategy Statement. The Strategic Goals for 2018-2020 are:

- We will use our statutory powers to increase compliance with competition and consumer protection law, taking enforcement actions where appropriate

- We will empower consumers to help them make informed decisions

- We will work to influence public debate and policy development, promoting competition and highlighting the interest of consumers

- We will support our staff’s ambition to maximise the CCPC’s impact and help our people achieve their potential

Role and functions

The agency carries out its role and functions in three main directions:

Enforce

- Enforcing Irish and European competition law in Ireland

- Enforcing consumer protection law

- Assessing mergers

- Enforcing product safety regulations

Inform

- Influencing public debate and policy development

- Informing consumers about their rights

- Encouraging business compliance

- Providing personal finance education to consumers

Protect & Regulate

- Monitoring compliance with the Grocery Sector Regulations

- Publicising authorised credit intermediaries

- Assessing applications of potential Alternative Dispute Resolution (aimed to resolve disputes between consumers and traders out-of-court) entities

Enforcement work

The CCPC is tasked with enforcing the Competition Act, which prohibits: 1) “all agreements between undertakings, decisions by associations of undertakings and concerted practices which have as their object or effect the prevention, restriction or distortion of competition in trade in any goods or services in the State or in any part of the State”; and 2) the abuse by a firm of a dominant position.

As an EU member, Ireland also enforces EU competition law, contained primarily in Articles 101 and 102 of the Treaty on the Functioning of the European Union (TFEU), which prohibits anti-competitive conduct that may have an effect on trade between EU Member States.

Businesses or individuals that breach competition law may be subject to civil or criminal sanctions. As regards civil sanctions, the CCPC has the power to apply to the Circuit court or the High Court to seek a declaration (i.e. a court ruling that a particular arrangement or behaviour is unlawful) or an injunction (e.g. a court ruling requiring a particular arrangement or behaviour to be terminated). As regards criminal sanctions, the CCPC can either itself bring a summary prosecution in the District Court or, in more serious cases, refer a case to the Director of Public Prosecutions (DPP) for prosecution on indictment. The following hardcore breaches of competition law are subject to the most severe criminal sanctions:

- Fixing or agreeing prices with competitors for goods and services, including the level of price increases or discounts

- Sharing markets among competitors by dividing up territories or sharing out customers

- Agreeing with competitors to limit production/supply by controlling the quantity of goods or services to be supplied in a given market

- Rigging bids among competitors so that one particular person or company wins the contract

Irish law does not allow the courts to impose any form of civil financial penalty on persons found to have breached competition law, nor does the CCPC itself have the power to impose administrative fines on persons it believes to have breached competition law. This may change when the Directive (EU) 2019/1 of the European Parliament and of the Council (known as ECN+ Directive), which intends to make national competition authorities more effective enforcers, comes into effect in 2021 (more details under “Future priorities” below).

In addition to investigating alleged anti-competitive behaviour, the CCPC is mandated to review mergers. Notifications of transactions over certain financial thresholds and all media mergers are mandatory. Otherwise, mergers or acquisitions can be notified to the CCPC on a voluntary basis. The merger review process requires the CCPC to make a determination during Phase 1 to either clear the merger, or to proceed to Phase 2 for a full investigation.

Recent enforcement work

In 2019, the CCPC opened a formal civil investigation into the conduct of a UK furniture wholesaler which required its retailers in Ireland not to charge prices below the suggested retail prices and restricted its retailers’ online selling activities. The CCPC also had a number of active civil investigations during the year regarding price signalling in the motor insurance market, the provision of tickets and the operation of ticketing services for live events, and conduct of the Restaurants Association of Ireland, among others.

In terms of criminal investigation, following in-depth investigation activities, the CCPC referred a case to the DPP in relation to potential bid-rigging in the procurement of publicly funded transport services in certain parts of Ireland.

As for mergers, the CCPC received 47 notifications in 2019, of which two were entered into Phase 2 after the CCPC raised competition concerns. Both were cleared eventually, subject to binding commitments. The first Phase 2 investigation concerned the proposed acquisition of sole control of MCD Productions Unlimited Company by LN-Gaiety Holdings Limited, both active at different levels of the supply chain for live music events in Ireland. After the CCPC raised competition concerns, the two parties submitted a number of legally binding commitments. The acquisition was eventually cleared.

In the second case related to the proposed acquisition of sole control of Kings Laundry Limited by Berendsen Ireland Limited – two of the three main providers of outsourced flat linen rental and maintenance services to healthcare customers in Ireland – the CCPC identified potential competition concerns, specifically in relation to the likely impact on prices and quality of services. Berendsen Ireland Limited subsequently submitted legally binding commitments, which were accepted by the CCPC and were required to be fulfilled before the transaction could be implemented.

More recently in 2020, the CCPC has cleared, subject to a binding commitment, the proposed transaction whereby certain interests of Celtic Rugby Designated Activity Company would be acquired by CVC through a newly incorporated company.

Simplified Merger Notification

Procedure Guidelines

Also in 2019, the CCPC secured Ireland’s first criminal prosecution for gun-jumping in relation to a merger. The investigation was opened in 2017, in which it was found that Armalou Holdings had acquired Lillis O’Donnell Motor Company Limited without submitting a notification to the CCPC. The two concerned parties pleaded guilty in April 2019.

It is noted that the total number of notified mergers in 2019 is 52% down from 2018, which can be attributed to the implementation of a higher merger financial threshold on 1 January 2019. During the same year, the CCPC began to prepare for the introduction of a new, simplified merger procedure, following consultations with various stakeholders. Without replacing the current procedure, the simplified merger procedure came into effect on 1 July 2020 to facilitate more efficient review of mergers that do not raise significant competition concerns.

Consumer protection activities

The CCPC is responsible for enforcing a wide range of legislation covering transactions between businesses and consumers across all sectors of the economy. In this regard, it has the power to take prosecutions, issue prohibition orders, Compliance Notices and Fixed Payment Notices, seek and obtain undertakings, and maintain the consumer protection list of companies and individuals against which it has taken an enforcement action.

In 2019, the CCPC conducted 99 inspections at traders’ premises to check compliance under consumer protection law. Altogether, 32 Fixed Payment Notices from traders were secured and 19 Compliance Notices about breaches were issued. The CCPC closed 10 enforcement requests received through the Consumer Protection Cooperation Network which consists of authorities responsible for enforcing EU consumer protection laws to protect consumers’ interests in EU and European Economic Area (EEA) countries. In addition, the Commission reviewed 79 complaints related to the Single Euro Payments Area (SEPA), an EU initiative that regulates cross-border electronic payments in euro across Europe.

Advocacy & research

The CCPC promotes competition in many ways, from highlighting areas of the economy where competition is restricted, to publishing reports on how competition and consumer protection may be improved in certain sectors, advising government departments and other state agencies on competition issues relevant to their work, commenting on proposed legislation and responding to public consultations.

In 2019, the Commission responded to 10 formal consultation processes and held 10 significant meetings with the government, regulators and law makers, covering a wide range of policy areas such as a national strategy on artificial intelligence and the reform of the education and training system for legal practitioners. It also engaged government departments on issues such as the detection of bid-rigging in public procurement and recommendations of the CCPC’s 2018 market study on the household waste sector, in addition to addressing four Joint Oireachtas (Parliamentary) Committees to discuss various topics.

Following a request by the then Minister for Business, Enterprise and Innovation, the CCPC commenced a market study on public liability insurance in 2019. A public consultation was launched in June 2020, covering a range of issues such as competitive conditions in the market, switching, digitalisation and the drivers of cost inflation.

The CCPC launched a research project on pricing strategies last year, out of concern that businesses in some sectors can increasingly exploit their information advantage brought by digitalisation, consumer disengagement and more complex products to prevent consumers from enjoying competition benefits. In addition to loyalty penalties and price walking, strategies such as dual pricing, personalised pricing and the use of pricing algorithms are also being reviewed. Particular concerns have been expressed at a political level in relation to dual pricing in the insurance and mortgage sectors.

Targeting businesses and consumers, the CCPC carries out different programmes to raise awareness of competition and consumer protection law. For instance, it engages small business owners and start-ups at “Taking Care of Business”, a free annual event organised by the DBEI, and organises outreach events to provide businesses with information on the practical steps they can take to prepare for Brexit.

The CCPC is also committed to promoting competition compliance through engaging businesses and trade associations. For example, the Irish Dancing Commission, after engagement with the CCPC, agreed in 2019 to amend their eligibility rules of entering Irish dancing competitions to ensure compliance with competition law.

The CCPC has continued its efforts in providing financial education programmes to educate consumers on managing their finances. In 2019, it delivered 113 talks in the workplace and community-based groups to about 3,500 people under its “Money skills for life” programme.

Response to COVID-19

COVID-19 has disrupted businesses worldwide, with Ireland being no exception. Under the special circumstances, various consumer-related issues have emerged, particularly regarding the delivery of goods and services and the regulation of health products like face masks.

To help consumers better understand their rights during the public health crisis, the CCPC launched a dedicated COVID-19 Information Hub in March 2020, highlighting issues consumers might be concerned about, such as travel and insurance.

At the same time, the CCPC has continued to ensure business compliance through different efforts. While continuing to perform its merger review function within statutory timeframes, the Commission has increased focus on sectors and issues impacted by COVID-19, as well as market surveillance activity and interaction with other government authorities to enable the timely provision of safe and compliant products by importers and manufacturers. The CCPC has also issued warnings to businesses to remind them that they must comply with competition and consumer protection law irrespective of the current challenges they may face.

On the EU level, the European Competition Network (ECN), of which the CCPC is a member, issued a joint statement in March to explain how the European competition rules should apply in situations caused by the COVID-19 outbreak. The CCPC has continued to work with other ECN members including the Directorate General for Competition to manage potential competition issues arising from the pandemic.

International co-operation

The CCPC participates in a large number of international competition and consumer protection organisations, including, on the EU level, the European Competition Network, the Consumer Protection Cooperation Network and several product safety networks. On the global level, the CCPC is an active participant in the Organisation for Economic Co-operation and Development (OECD), the International Competition Network and the International Consumer Protection and Enforcement Network.

During the period, the CCPC participated in the following meetings:

| Platform | Number of meetings |

|---|---|

| European Competition Network | 31 |

| International Competition Network | 4 |

| Consumer Protection Cooperation Network | 16 |

| OECD | 14 |

| Product safety networks | 13 |

Meanwhile, the Commission takes part in staff exchange programmes from time to time with other national consumer agencies, such as Lithuanian and Swedish authorities. In 2019, the CCPC’s Head of Digital Investigations Unit visited the Danish Competition and Consumer Authority to observe their digital investigation laboratory and practices.

Future priorities

Apart from continuing its efforts on enforcing competition rules, the CCPC will work with the DBEI to give effect to a number of legislative provisions under the New Deal for Consumers and the Digital Single Market Strategy. As part of the strategy, the CCPC considers it necessary to focus on digital policies and national strategies with a focus on coordinating regulatory powers.

In the meantime, the CCPC and the DBEI are working on the transposition of the ECN+ Directive, which was signed into law in December 2018 with the aim of empowering the competition authorities of the EU Member States to be more effective enforcers and to ensure the proper functioning on the internal market. The ECN+ Directive will come into effect in 2021 and introduce a number of significant changes to the current competition law enforcement regime in Ireland, in particular, the requirement to introduce non-criminal financial sanctions for breaches of EU competition law or breaches of both EU and Irish competition law.

Another imminent task of the CCPC is to prepare for Brexit. The CCPC will continue to assess and prepare for the impact of Brexit on consumers, businesses and all areas of responsibility by building on and strengthening relationships with UK agencies and authorities, product safety, competition and consumer protection bodies in other EU Member States, and European Commission Directorates.

The CCPC will develop a new Strategy Statement in 2020 to guide the organisation through the years 2021-23.

(Published in September 2020)